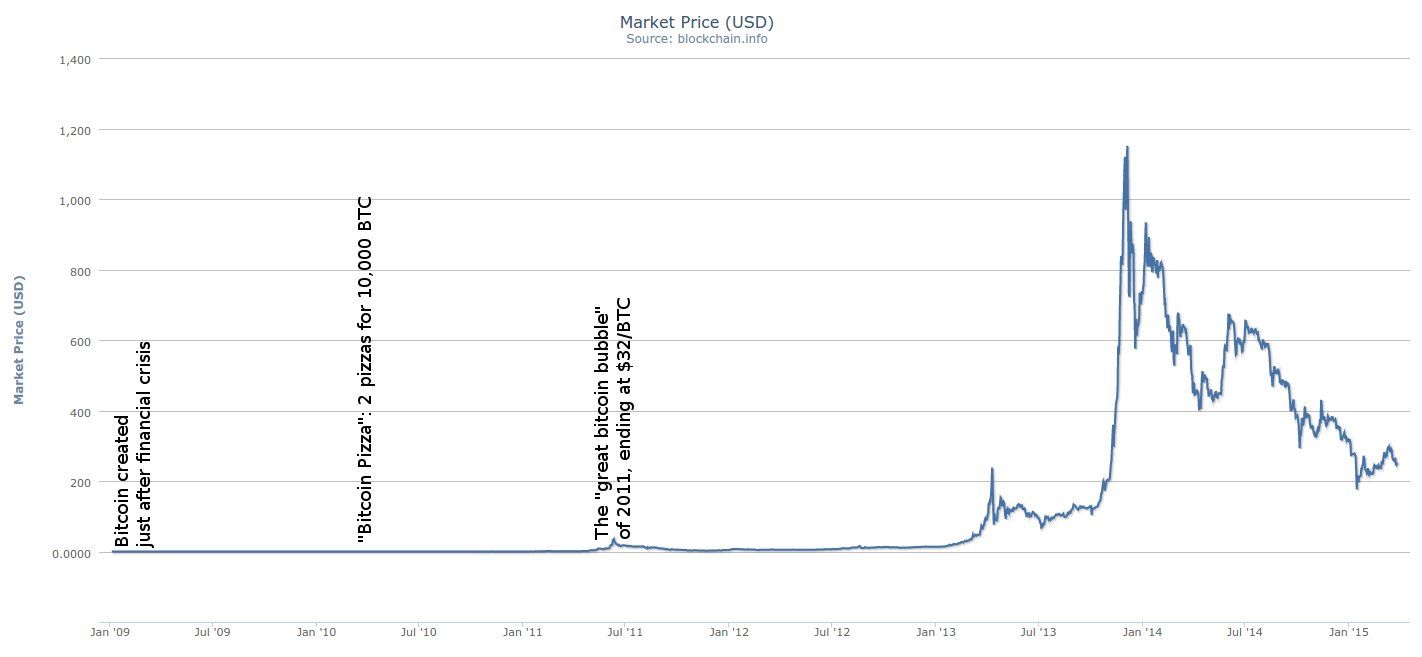

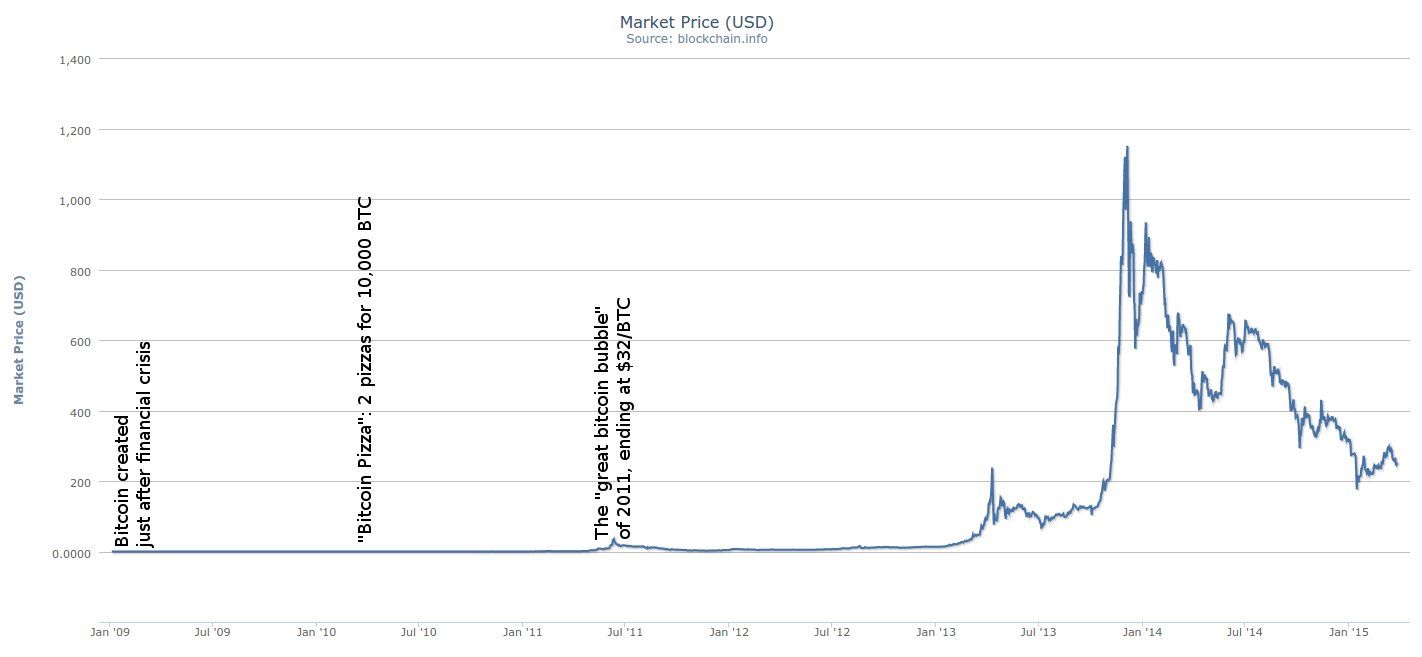

The US dollar to bitcoin conversion rate has been quite volatile, with single-day drops exceeding 50 percent.

Value stability can be a problem with any currency, where there are two macroeconomic error conditions:

| If you're a buyer, you want... |

If you're a seller, you want... |

If you're a criminal, you want... |

|

|

|

|

|

|